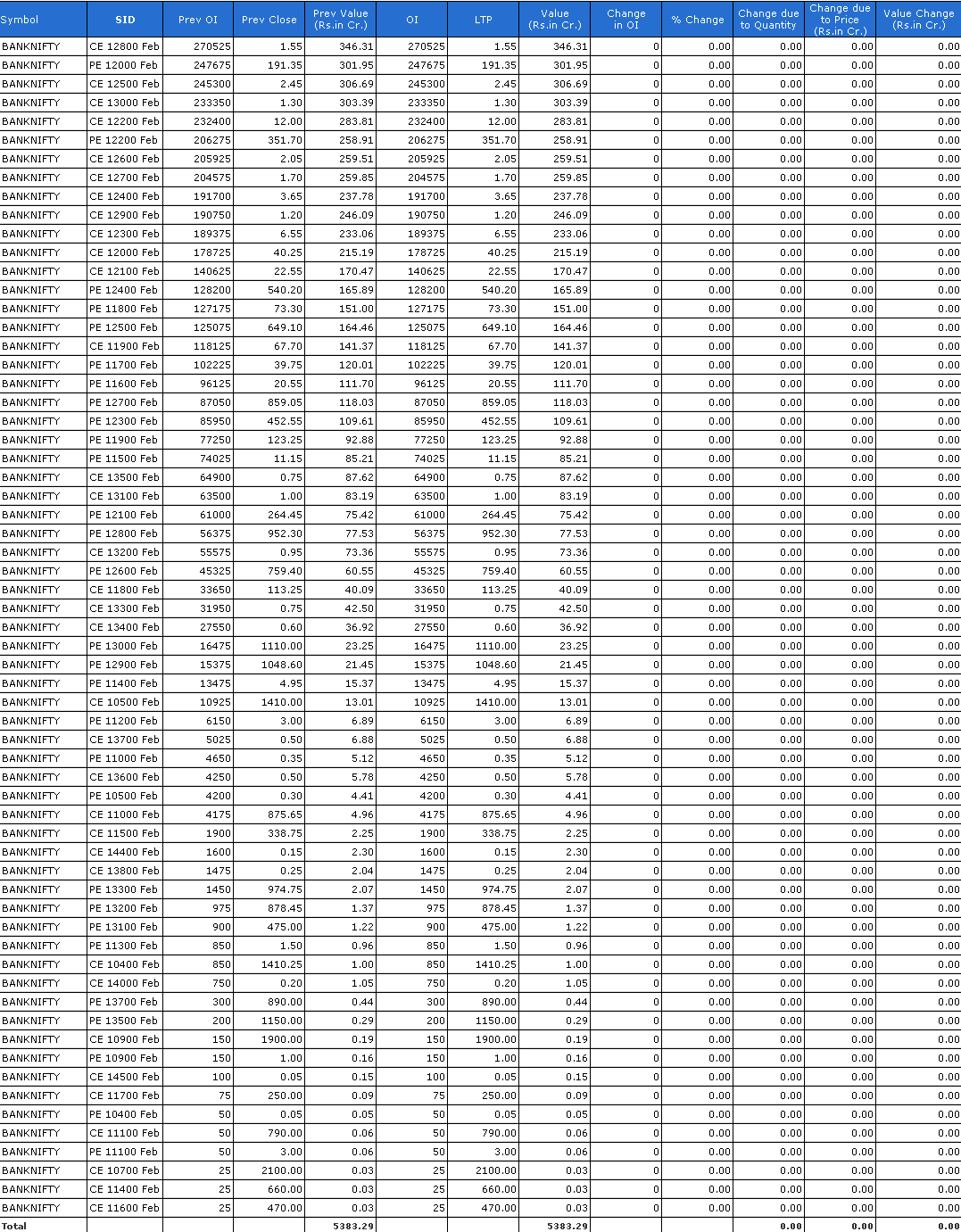

The final selection of 12 companies will be based on the free-float market capitalization (non-promoter) of the companies in question.The index methodology states that only companies that are allowed to trade in F&O segment will be eligible to be included in the Bank Nifty Index.

The only exception is when an otherwise eligible company comes out with an IPO and is able to fulfil all the other criteria for inclusion in the index for a 3-month period.

Nifty bank moneycontrol full#

If the number of stocks representing the Nifty Bank index falls below 10 in the Nifty 500, then the deficit stocks will be selected from the top 800 stocks ranked by a combination of average daily turnover and 6-months average daily full market cap.The index review will be conducted twice a year. The said company must be traded on the NSE and form part of NIFTY 500 at the time of review.Here is the eligibility criteria for the companies to be included in the Bank Nifty.

0 kommentar(er)

0 kommentar(er)